Philadelphia Bad Faith Insurance Lawyers

Don't get taken advantage of.

Insurance companies will never come out and say that they have acted in bad faith, but they may have taken steps in hopes that you abandon your claim.

Get a Free Consultation Now

Hear From Our Clients

Bridget is the consummate attorney. She walked me through the process and stayed in touch with me while my claim processed. I knew I could call her anytime with any questions and she is up front and honest. I’m so grateful to have had her on my case.

I am so thankful for Muller Brazil. My medical bills were taken care of which was the most important thing for me going forward. I feel like i got vip service ... Thanks again y'all.

Leigh went above and beyond always for me on my case. She sent me updates often and made me feel important. Which is the case got overwhelming at times, Leigh always made me feel at ease and worked tirelessly for me. She is exceptional at what she does and concerns for her clients. Continued Blessings Leigh!

Protecting Your Legal Rights as a Policyholder in Philadelphia

$375k Won for a Motorcycle Accident

Have you ever felt frustrated and helpless because your insurance company denied your claim without a valid reason? You’re not alone. Many policyholders in Philadelphia face this same struggle, dealing with insurance companies that don’t uphold their promises. When an insurer acts in bad faith, it results in financial and emotional distress. Understanding your rights and the steps you can take to fight back against unfair insurance practices is key. Let's give you the knowledge needed to stand up to your insurance company!

As a policyholder in Philadelphia, you have specific rights that protect you from unfair treatment by your insurance company. Knowing these rights is the first step in making sure that you are not taken advantage of. Here are some key points to understand:

Right to Fair Treatment: Your insurance company is obligated to treat you fairly and honestly. This means they must handle your claim promptly and without unnecessary delays.

Right to Full Disclosure: Insurers must provide clear and complete information about your policy, including what is covered, what is excluded, and the process for filing a claim.

Right to a Reasonable Explanation: If your claim is denied, your insurance company must provide a valid and detailed explanation. They cannot simply deny your claim without justification.

Right to Appeal: If you believe your claim was wrongly denied or underpaid, you have the right to appeal the decision. This process should be outlined in your policy documents.

Legal Protections in Pennsylvania: The Pennsylvania Insurance Bad Faith Statute (42 Pa.C.S. § 8371) offers additional protections. If an insurer is found to have acted in bad faith, the statute allows courts to:

- Award interest on the claim amount from the date it was made.

- Impose punitive damages against the insurer.

- Assess court costs and attorney fees against the insurer

What Is a Bad Faith Claim Against an Insurance Company?

$190k Won for a Slip & Fall

A bad faith claim arises when an insurance company fails to uphold its obligations to its policyholders. These obligations include handling claims promptly, fairly, and in good faith. When an insurer breaches these duties, it can be held liable for bad faith. Here’s a closer look at what constitutes a bad faith claim and the legal grounds for filing one:

Definition and Explanation of Bad Faith Claims

- Bad Faith Conduct: This occurs when an insurer unreasonably denies a claim, delays processing a claim, or fails to investigate a claim properly. Bad faith can also involve misrepresenting policy terms or failing to communicate adequately with the policyholder.

- Legal Grounds: To succeed in a bad faith claim, the policyholder must demonstrate that the insurer lacked a reasonable basis for denying benefits and knew or recklessly disregarded this lack of a reasonable basis.

Legal Grounds for Filing a Bad Faith Claim

- Statutory Basis: Under Pennsylvania law, 42 Pa.C.S. § 8371, if a court finds that an insurer has acted in bad faith, it may award interest, punitive damages, and assess court costs and attorney fees against the insurer.

- Common Law Remedies: In addition to statutory claims, policyholders may also pursue common law remedies, such as breach of contract or fraud, depending on the specifics of the case.

Examples of Bad Faith Practices By Insurance Companies

$150k Won for a Defective Knee Implant

Insurance companies sometimes engage in bad faith practices, which can severely impact policyholders. Here are some common examples of bad faith practices by insurers:

Delayed Payments

- After a car accident, you file a claim for repairs. Instead of processing your claim promptly, the insurer delays the payment without a valid reason, causing you financial strain and inconvenience.

Denial of Valid Claims

- Your home suffers significant damage from a storm. Despite having comprehensive coverage, your insurance company denies the claim, citing unreasonable or non-existent policy exclusions.

Underpayment of Claims

- You submit a medical claim for a covered procedure. The insurer agrees to pay but offers an amount far below what is required to cover the costs, forcing you to pay out of pocket for the remainder.

Misrepresentation of Policy Terms

- When you purchased your policy, the insurer assured you that flood damage was covered. However, when you file a claim for flood damage, they deny it, claiming the policy excludes such coverage, despite your previous understanding.

Failure to Conduct a Proper Investigation

- You file a claim for theft. Instead of thoroughly investigating the incident, the insurer dismisses your claim, alleging insufficient evidence, without actually examining the details of the case.

Common Warning Signs of Bad Faith Insurance Practices in Philadelphia

$3.1M Won for a Vaccine Injury

Recognizing the warning signs of bad faith insurance practices can help you take action before it’s too late. Here are some common indicators that your insurer may not be acting in good faith:

Unreasonable Delays in Claim Processing

If your insurance company is taking an unusually long time to process your claim without a valid reason, this could be a sign of bad faith. Insurers are required to handle claims promptly and efficiently.

Lack of Communication

Frequent difficulty in contacting your insurer or receiving clear updates about your claim status can indicate bad faith. Insurance companies should provide regular and transparent communication.

Insufficient Investigation

When an insurer denies your claim without conducting a thorough investigation, or if the investigation appears superficial or biased, it could be acting in bad faith. Proper investigation is a critical part of fair claim handling.

Inadequate or Misleading Explanations for Denial

If your claim is denied and the insurer provides vague, inconsistent, or misleading reasons, this could be a red flag. A legitimate denial should be based on clear, policy-specific reasons.

Pressure to Accept Low Settlements

Insurers acting in bad faith may pressure you to accept a settlement that is significantly lower than what your claim is worth. They may use tactics to convince you that this is your best or only option.

Policy Misrepresentation

If your insurance company misrepresents the terms and conditions of your policy, such as coverage limits or exclusions, they may be engaging in bad faith practices.

Bad Faith Doesn’t Only Come from Insurance Providers

There are a number of other ways in which bad faith arrives, not just dealing with insurance companies. If any of these sound familiar then it may be time to give us a call!

Contracts

- Business Contracts: When one party to a contract deliberately fails to fulfill their obligations, misrepresents terms, or engages in deceptive practices.

- Real Estate Transactions: Misrepresentation of property conditions, failure to disclose defects, or other dishonest practices by sellers, buyers, or agents.

Employment

- Wrongful Termination: Employers may act in bad faith by firing an employee for reasons not allowed by the contract or by law, or by fabricating reasons for termination.

- Employment Contracts: Breach of employment agreements, such as failing to provide agreed-upon benefits, promotions, or job security.

Consumer Rights

- Product Warranties: Manufacturers or sellers failing to honor warranties or guarantees provided with a product.

- Loan Agreements: Lenders misrepresenting terms, engaging in predatory lending practices, or failing to disclose crucial information to borrowers.

Family Law

- Divorce Proceedings: One party hiding assets, lying about income, or otherwise acting deceptively during divorce negotiations or litigation.

- Custody Agreements: Failing to adhere to agreed-upon terms regarding child custody or support.

Financial Services

- Investment Advisors: Providing misleading information or failing to act in the best interests of clients.

- Banking: Misleading customers about loan terms, fees, or other financial products.

Government and Public Services

- Regulatory Agencies: Agencies acting in bad faith by failing to enforce laws or regulations fairly and impartially.

- Public Contracts: Government bodies or officials engaging in corrupt practices or failing to fulfill contractual obligations to contractors.

Areas We Serve

FAQs

-

Steps to take if you suspect bad faith

Document Everything: Keep detailed records of all communications with your insurer, including emails, letters, and phone calls. Note dates, times, and the names of representatives you speak with.

Request Written Explanations: Ask for written explanations for any delays, denials, or settlement offers. This can provide evidence of bad faith practices if you decide to pursue legal action.

Consult with a Legal Professional: If you suspect your insurer is acting in bad faith, consult with an attorney who specializes in insurance disputes. They can help you understand your rights and explore your options for holding the insurer accountable.

By recognizing these warning signs and taking appropriate steps, you can protect yourself from bad faith practices and ensure you receive the coverage and compensation you deserve.

-

How to obtain a settlement

If you believe your insurance company is acting in bad faith, pursuing a settlement is essential. Here's a simplified process to help you understand how to achieve a fair resolution:

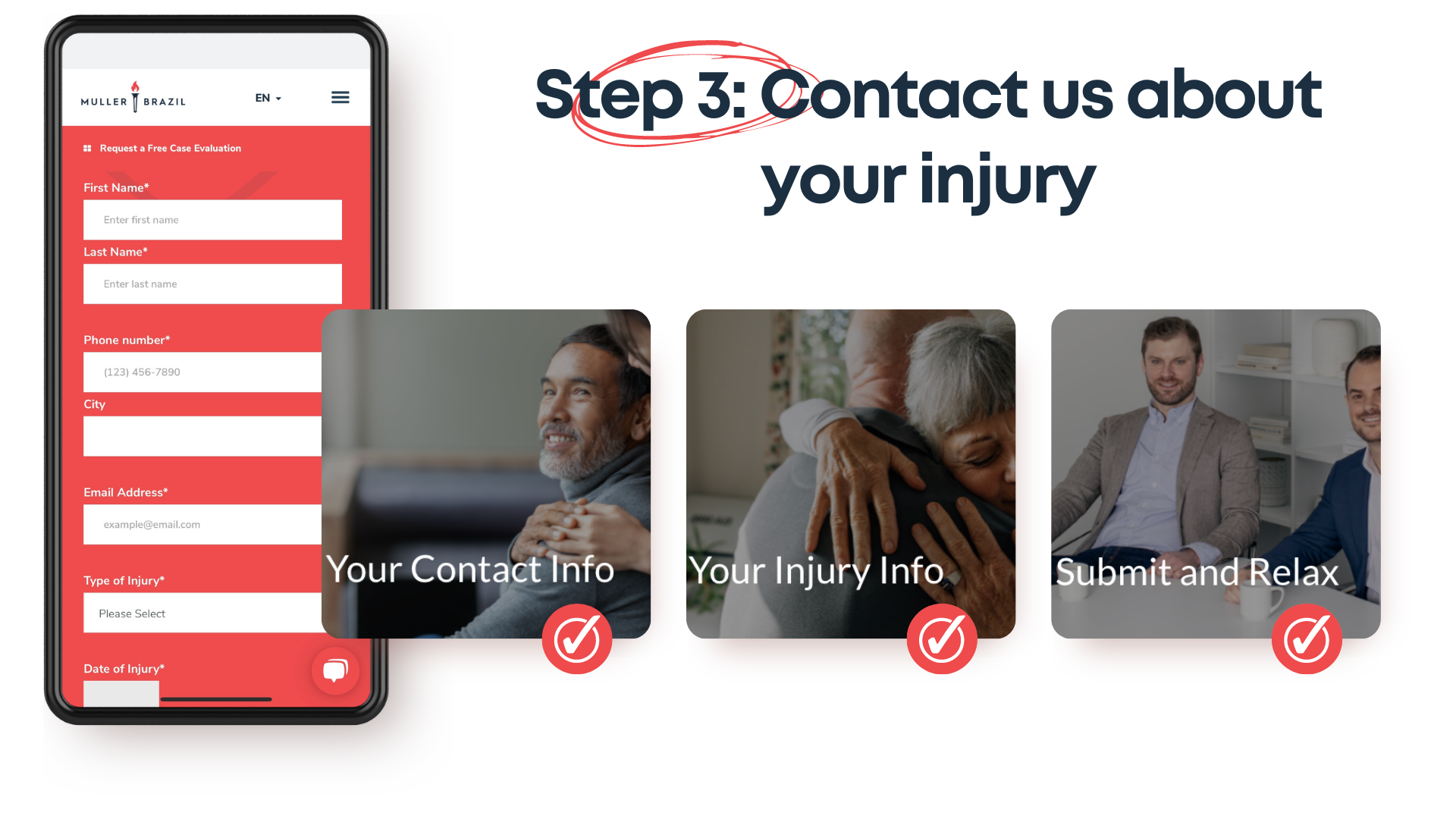

Consult a Legal Professional:

- Why It’s Important: An experienced attorney can help you understand your rights, gather necessary evidence, and navigate the legal system effectively.

Gather Evidence:

- Documentation: Collect all relevant documents, including policy details, correspondence, and claim records.

- Expert Testimony: Sometimes, expert opinions are needed to prove the insurer’s unreasonable actions.

File the Claim:

- Legal Complaint: Your attorney will file a formal complaint detailing your allegations and the compensation sought.

- Serve the Complaint: The insurer must be officially notified of the lawsuit.

Discovery Phase:

- Evidence Exchange: Both parties share relevant information, including depositions and documents.

- Building Your Case: Your attorney uses this information to strengthen your case.

Negotiation and Settlement:

- Settlement Discussions: Insurance companies often prefer to settle claims out of court to avoid lengthy litigation.

- Mediation: Sometimes, a mediator helps both parties reach an agreement.

Trial:

- Court Proceedings: If no settlement is reached, the case goes to trial.

- Judgment: The court decides the outcome based on presented evidence.

-

What kind of damages could I receive from a successful claim?

When you successfully prove a bad faith claim against your insurance company, you may be entitled to various types of damages. Here’s what you could potentially receive:

Compensatory Damages

These damages are intended to compensate you for the actual financial losses caused by the insurer’s bad faith actions. This can include unpaid claim amounts, additional expenses incurred due to delayed payments, and other direct financial impacts.

Punitive Damages

Punitive damages are awarded to punish the insurer for its wrongful conduct and to deter similar behavior in the future. These are in addition to compensatory damages and can be substantial.

Interest on the Claim Amount

Pennsylvania law allows for the awarding of interest on the claim amount from the date it was made. This is calculated at the prime rate of interest plus 3%.

Court Costs and Attorney Fees

To make sure that policyholders are not financially burdened by legal costs, the court may require the insurer to pay for court costs and attorney fees.

-

Why choose Muller Brazil?

Selecting the right legal representation is crucial in a bad faith insurance claim. Here’s why Muller Brazil is the right choice for you:

Proven Success: Muller Brazil has a strong track record of successfully handling bad faith insurance claims, securing significant settlements and verdicts for their clients.

Client-Focused Approach: The firm prioritizes personalized attention and transparent communication, ensuring clients are well-informed throughout the process.

Experienced Legal Team: With skilled attorneys knowledgeable in insurance law, Muller Brazil can navigate legal issues effectively.

Strong Client Advocacy: The firm is dedicated to holding insurance companies accountable and helping policyholders receive the compensation they deserve.

Don’t just take our word for it! This is what our clients are saying about us.

Dealing with a bad faith insurance claim can be stressful and overwhelming. Muller Brazil is here to provide the support you need to protect your rights. By understanding and recognizing the signs of bad faith practices, you can take action against unfair treatment. With Muller Brazil on your side, you have a dedicated team ready to fight for you.

Don’t let your insurance company take advantage of you. Contact Muller Brazil today to discuss your case and explore your options. Our attorneys are committed to achieving the best possible outcome for you.

-

What should I do if my workers’ compensation claim was denied?

We’ve seen many instances where a workers’ compensation claim was denied but the employee is too injured to return to work due to a permanent disability. If you’re not sure what to do, get in touch with Muller Brazil today to find out how we can help.

Related Blog Posts

6 min read

Who Is at Fault in Rear-End Collision?

Feb 20, 2025 by Paul R. Brazil, Esquire

6 min read

Not at Fault Insurance Claim: Legal Help and Tips

Feb 20, 2025 by Maximillian J. Muller, Esquire

6 min read

What to Do If a Vehicle Damages Your Property

Feb 18, 2025 by Paul R. Brazil, Esquire

Our Consultations Are Always Free

Don't worry, you won't be passed along to staff like other law firms - speak directly with our lawyers today.

.jpg)