Philadelphia Insurance Denials Lawyers

A proven track record of recovering compensation.

If your insurance claim has been denied, it doesn’t mean it’s the end of the line.

Get a Free Consultation Now

Hear From Our Clients

Bridget is the consummate attorney. She walked me through the process and stayed in touch with me while my claim processed. I knew I could call her anytime with any questions and she is up front and honest. I’m so grateful to have had her on my case.

I am so thankful for Muller Brazil. My medical bills were taken care of which was the most important thing for me going forward. I feel like i got vip service ... Thanks again y'all.

Leigh went above and beyond always for me on my case. She sent me updates often and made me feel important. Which is the case got overwhelming at times, Leigh always made me feel at ease and worked tirelessly for me. She is exceptional at what she does and concerns for her clients. Continued Blessings Leigh!

Why Do Insurers Deny Claims?

$375k Won for a Motorcycle Accident

Picture this: after a devastating house fire, you turn to your insurance company for help, only to be met with a denied claim. The stress and frustration of rebuilding your life are compounded by an insurance company that refuses to honor its promises.

Unfortunately, this scenario is all too common. On average, insurance companies denied 17% of in-network health insurance claims filed in 2021 (U.S. PIRG). At Muller Brazil, we know the injustice of being wrongfully denied. Our Philadelphia Insurance Denial Lawyers are here to fight for your rights and make sure that you receive the money you are owed. Insurance companies deny claims for various reasons, often relying on technicalities or complex policy language to avoid paying out. Understanding these common reasons can help you see through their tactics:

- Pre-existing Conditions: Claims denied based on conditions that existed before the policy was in effect.

- Policy Exclusions: Denials due to specific exclusions in the policy that the policyholder may not have been aware of.

- Insufficient Documentation: Claims rejected because of missing or incomplete documentation.

- Late Filing: Denials based on claims being filed outside the allowable time frame.

- Misrepresentation: Claims denied due to alleged misrepresentation of facts by the policyholder.

Common Warning Signs of Bad Faith Insurance Practices in Philadelphia

$190k Won for a Slip & Fall

Insurance companies sometimes engage in bad faith practices to avoid paying claims. Being aware of these warning signs can help you identify when your insurer might be acting in bad faith:

- Delaying Processing: Unreasonable delays in handling your claim.

- Lowball Offers: Offering significantly less compensation than what your claim is worth.

- Lack of Communication: Failing to respond to your inquiries in a timely manner.

- Misrepresentation: Providing misleading information about policy coverage or the claim process.

- Unreasonable Denial: Denying claims without a valid reason or proper investigation.

First-Party and Third-Party Insurance Claim Denials

Understanding the difference between first-party and third-party insurance claims is important when dealing with the denial process:

First-Party Claims

First-party claims are those you file directly with your own insurance company for benefits under your policy. Common types include:

- Health Insurance Claims: Seeking coverage for medical treatments.

The top reasons for claim denials include 37% due to prior authorization required, 26% for services not covered, and 19% for lack of medical necessity. (source) - Auto Insurance Claims: Filing for damages to your vehicle or personal injury.

11% of auto insurance claims are denied due to disputes over fault, 8% for lack of proper documentation, and 5% for allegations of fraud. (source) - Homeowner’s Insurance Claims: Claiming for property damage or loss.

Minority homeowners are 25% more likely to have their claims denied compared to non-minorities. (source)

Third-Party Claims

Third-party claims are those you file against another party’s insurance company. Examples include:

- Auto Accident Claims: Filing against the at-fault driver’s insurance for damages and injuries.

- Liability Claims: Seeking compensation for injuries sustained on someone else’s property.

Both types of claims can be denied for various reasons, but understanding the distinctions can help you approach the appeals process more effectively.

What Is a Bad Faith Claim Against an Insurance Company?

$150k Won for a Defective Knee Implant

A bad faith claim comes up when an insurance company fails to act in good faith and fair dealing with its policyholders. This type of claim can be filed if an insurer engages in unfair practices to avoid paying a legitimate claim. Here are some common examples:

- Unjust Denials: Refusing to pay a legitimate claim without a valid reason.

- Failure to Investigate: Not conducting a proper investigation before denying a claim.

- Misleading Policyholders: Providing false or misleading information about the policy or claims process.

- Delaying Payments: Unreasonably delaying payment of a claim without justification.

- Lowball Offers: Offering significantly less compensation than the claim is worth without a reasonable basis.

Failure to Provide a Reasonable Explanation for Claim Denial

Insurance companies are legally required to provide a reasonable explanation when they deny a claim. If an insurer fails to offer a clear and valid reason for the denial, it may be acting in bad faith. Here’s what you need to know:

Legal Obligations of Insurers

- Transparency: Insurers must clearly state the specific reasons for denying a claim.

- Policy References: They should reference the relevant policy provisions that justify the denial.

- Detailed Communication: Insurers must provide detailed explanations rather than vague or general statements.

Consequences of Inadequate Explanations

When an insurance company fails to provide a reasonable explanation for denying your claim, it can:

- Indicate Bad Faith: Suggest that the insurer is not acting in good faith.

- Strengthen Your Case: Serve as evidence if you decide to pursue a bad faith claim against the insurer.

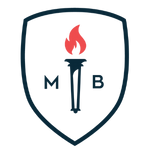

What To Do If Your Insurance Denies Your Claim

If your insurance claim is denied, taking the right steps quickly can make a significant difference:

- Review the Denial Letter: Understand the reasons for the denial and the policy provisions cited.

- Gather Documentation: Collect all relevant documents and keep detailed records of interactions with your insurer.

- Contact an Attorney: Seek legal advice to evaluate your case and explore your options.

- File an Appeal: Work with your attorney to address the denial reasons and submit any additional required documentation.

- Consider Legal Action: If the appeal fails, your attorney can help you pursue a lawsuit for bad faith practices.

Areas We Serve

The Importance of Legal Representation

$3.1M Won for a Vaccine Injury

When facing an insurance claim denial, having skilled legal representation can make all the difference. Insurance companies often rely on complex procedures and hope policyholders will give up, but at Muller Brazil, we turn the tide in your favor.

Why Choose Muller Brazil?

- Proven Expertise: Our attorneys have a deep understanding of insurance policies and the legal grounds for challenging denials. We have successfully overturned numerous denied claims, securing rightful compensation for our clients.

- Aggressive Advocacy: We fight tirelessly for our clients, guaranteeing that their claims are taken seriously by the insurance companies. Our aggressive approach has led to significant settlements and verdicts.

- Personalized Attention: At Muller Brazil, we treat each case with the individual attention it deserves. Our team will work closely with you, keeping you informed and involved throughout the process.

- Higher Success Rates: Clients who work with us often achieve better outcomes than those who go it alone. Our track record speaks for itself, with numerous cases resulting in favorable resolutions.

Read more about the Muller Brazil way.

How We Can Help

At Muller Brazil, our attorneys can:

- Review Your Denial Letter: Assess whether the explanation provided is adequate and lawful.

- Challenge Unjust Denials: Help you appeal the denial and fight for the benefits you are entitled to.

- Pursue Bad Faith Claims: If necessary, we will take legal action against the insurer for failing to act in good faith.

If your insurance claim has been denied without a reasonable explanation, contact Muller Brazil for a free consultation. We are here to make sure that your rights are protected!

FAQs

-

What should I do if my insurance claim is denied?

If your insurance claim is denied, first review the denial letter to understand the reasons provided. Gather all relevant documentation and consider consulting an experienced insurance denial lawyer to evaluate your case and guide you through the appeals process.

-

How long do I have to appeal a denied insurance claim?

The timeframe to appeal a denied insurance claim varies depending on your insurance policy and state regulations. It’s important to act quickly and consult with an attorney to ensure you meet all necessary deadlines.

-

Can I still file a claim if I missed the appeal deadline?

Missing the appeal deadline can complicate your case, but you may still have options. An experienced attorney can help assess your situation and determine if there are any exceptions or alternative legal actions you can take.

-

What are my chances of winning an appeal against an insurance company?

While every case is unique, having legal representation significantly increases your chances of success. Our attorneys at Muller Brazil have a proven track record of successfully overturning denied claims and securing substantial compensation for our clients.

Related Blog Posts

6 min read

Who Is at Fault in Rear-End Collision?

Feb 20, 2025 by Paul R. Brazil, Esquire

6 min read

Not at Fault Insurance Claim: Legal Help and Tips

Feb 20, 2025 by Maximillian J. Muller, Esquire

6 min read

What to Do If a Vehicle Damages Your Property

Feb 18, 2025 by Paul R. Brazil, Esquire

Our Consultations Are Always Free

Don't worry, you won't be passed along to staff like other law firms - speak directly with our lawyers today.

.jpg)